Cost Concept and Classification

Read these Top 30 Questions and Answers- Cost Terms Concepts and Classification and improve your accounting skills and knowledges. A period cost is a cost that is taken directly to the income statement as an expense in the period in which it is incurred.

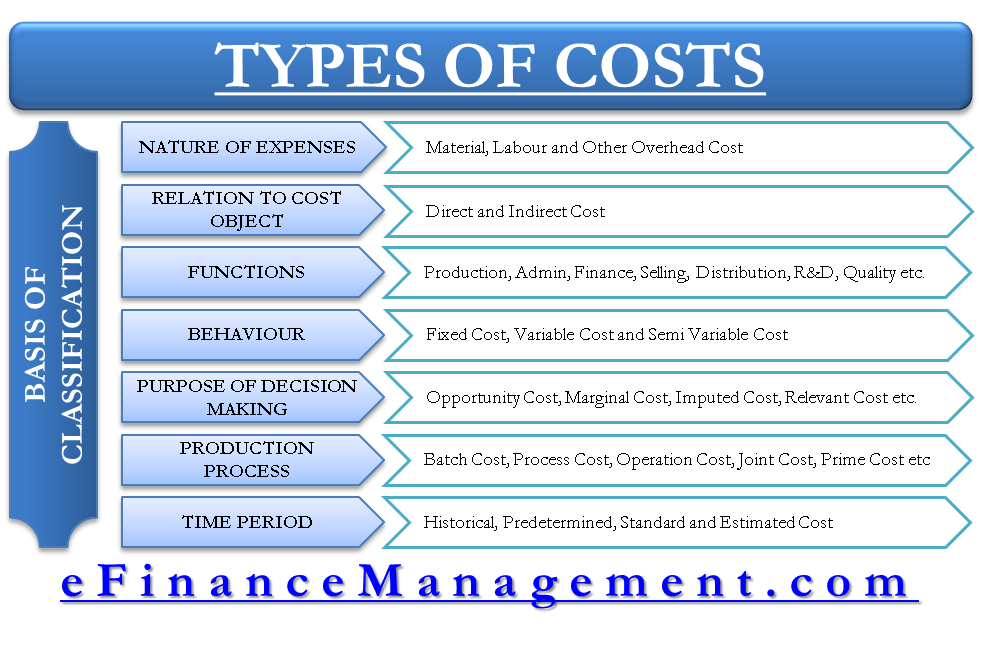

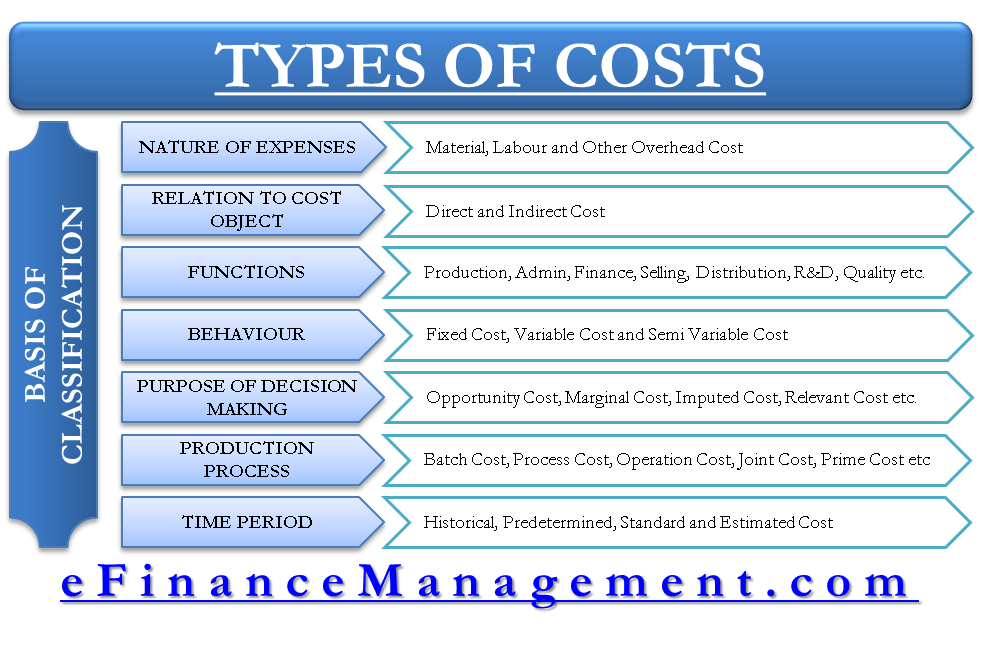

Types And Basis Of Cost Classification Nature Functions Behavior Efm

So basically there are three broad categories as per this classification namely Labor Cost Materials Cost and Expenses.

. Classification is the arrangement of cost items in logical groups having regard to their nature subjective classification or purpose objective classification to be achieved and requirement of an organizations. Let us divide as per their natures. Get The Freedom To Learn And The Skills To Succeed With Alisons Free Certificate Courses.

Cost Classification by Nature 2. Total Cost of a Trading Concern. We have three suppliers - A B and C.

Cost refers to the value sacrificed with the aim of gaining something in return. I hope at the end of the article you have a basic idea about the Cost Terms Concepts and Classification. Properly account for labor costs associated with idle time overtime and fringe benefits.

Value foregone or sacrifice of resources for the purpose of achieving some economic benefit which will promote the profit-making ability of the firm. COST CONCEPTS CLASSIFICATIONS AND BEHAVIOR. 17 Receiving Cost Total Cost Marketing or Selüng Cost Pericd Cost Ad Cost Marketing or Selling Cost.

Cost Classification in Relation to Cost Centre 3. Det er gratis at tilmelde sig og byde på jobs. In the case of manufactured goods these costs consist of direct materials direct labor and manufacturing overhead.

Cost Classification by Nature of Production Process. Manufacturing incurred in the production i. Cost Classification by Time 4.

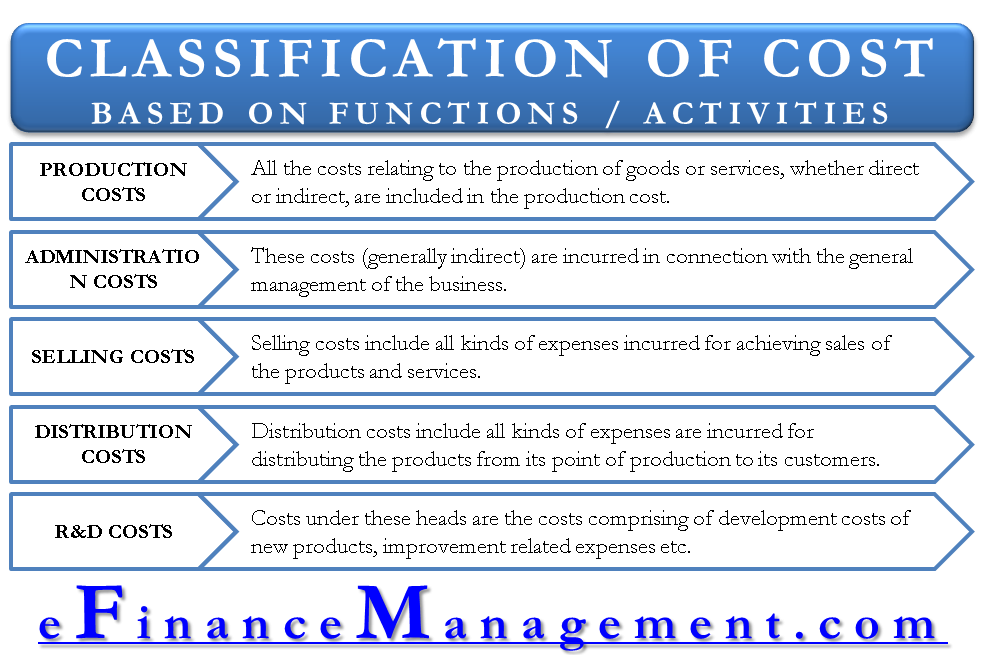

COST TERMS CONCEPTS AND COST TERMS CONCEPTS AND CLASSIFICATIONS AN OVERVIEW OF COST TERMS. The following points highlight the five main types of classification of costs. Marketing or selling cost Include all costs of marketing research getting orders.

Cost monetary amount of the resources given up or sacrificed to attain some objectives such as acquiring goods and services. There will be a P20 out-of-pocket cost. It means economic sacrifice measured in terms of standard monetary unit incurred or potentially to be incurred a.

Conversion costs Direct manufacturing labor costs Manufacturing overhead costs. Classification is the arrangement of cost items in logical groups having regard to their nature subjective classification or purpose objective classification to be achieved and requirement of an organizations. Differential costs opportunity costs and sunk costs.

Classification of costs is the process by which costs are grouped according to some common characteristics. According to Elements Under the circumstances costs are classified into three broad categories Material Labour and Overhead. Søg efter jobs der relaterer sig til Cost concept and classification pdf eller ansæt på verdens største freelance-markedsplads med 21m jobs.

Cost Concept and Classification. Cost Concept and Classifications -. Define and give examples of cost classifications used in making decisions.

Ad Free Online Introduction To Cost Accounting And Cost Classification - With Certificate. If we buy from C because he is our relative. View Cost_Concept_and_Classificationsdoc from ACCTG AFAR at Tarlac State University - San Vicente Campus.

COST ESTIMATION AND FORECASTING 31 Cost Concept and Classification Cost Cost is defined as the resources foregone or sacrificed to a specific objective It is therefore the monetary unit that must be given up for goods and services. 1 Classification by Nature This is the analytical classification of costs. There will be a P30 opportunity cost.

A sells the raw materials for P100 per kilo B sells the raw materials for P120 per kilo and C sells the raw materials for P130 per kilo. It also an outlay or expenditure of the money to acquire goods and services the assist in performing operations. Cost classification is the logical process of categorising the different costs involved in a business process according to their type nature frequency and other features to fulfil accounting objectives and facilitate economic analysis.

Microsoft PowerPoint - 02Cost Terms - Part 1ppt Compatibility Mode Author. Now further subdivision may also be made for each of them. The classification of cost may be depicted as given.

PERIOD COSTS Factory Sales Administration. For example Material may be subdivided into raw materials packing materials consumable stores etc. Classification of costs is the process by which costs are grouped according to some common characteristics.

Concept of cost It is the amount of expenditure incurred or attributable to a given thing It is the measurement in monetary terms of the amount of resources used for the purpose of production of goods or rendering services. Prepare and interpret a quality cost report. 2-3 A product cost is any cost involved in purchasing or manufacturing goods.

Product services or a combination of product. Identify the four types of quality costs associated and explain how they interact. Cost Classification for Decision Making 5.

Cost objects This is any activity for which a separate measurement of cost is desired eg.

Classification Of Costs Based On Functions Activities Efm

Cost Accounting Elements Of Cost

Cost Classification Defintion Basis Types Of Costs In Accounting

Accounting Taxation Costing Concepts Cost Sheet Objectives Types Of Cost Centre Methods Of Costing Cost Sheet Cost Accounting Managerial Accounting

0 Response to "Cost Concept and Classification"

Post a Comment